Stamp duty is a tax on the sale or transfer of property that is charged by each state and territory.

It is the buyer who pays the duty, not the seller and it is a good idea for buyers to factor this tax into the budget when searching for a property to avoid any unwanted surprises when it comes time to settle. There are many stamp duty calculators available online which can give an indication of the amount that will be payable.

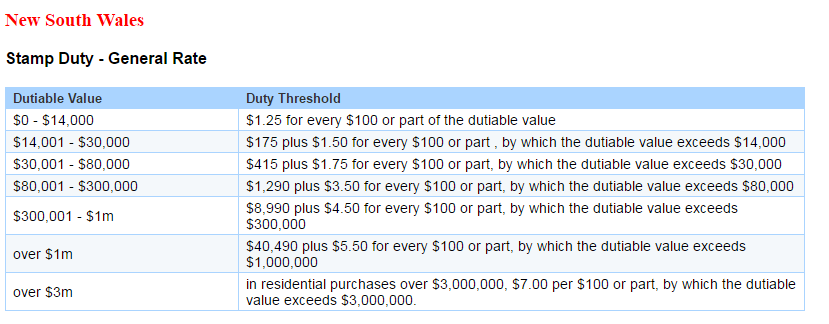

The rate of stamp duty applicable when buying a property varies according to the selling price and type of property as well as the state in which the property is located and whether the buyer is intending to live there. The table below outlines the stamp duty rates in NSW.

Source: www.visionabacus.com

Source: www.visionabacus.com

There are exemptions from paying stamp duty and you can apply for exemptions through your solicitor or conveyancer (me!). We can ensure your application is filled in correctly and that all supporting documentation is included to make the process a smooth one.

Exemptions are available for first home buyers purchasing a new home up to the value of $550,000 and concessions are available for first home buyers purchasing a new home valued between $550,000 and $650,000. There are also exemptions for purchases of vacant land.

There are some eligibility criteria for exemptions which can be found on the Office of State Revenue website.

Stamp duty has recently been in the news due to its impact on housing affordability, particularly in Sydney, with a number of suggested changes put forward for change. At the time of writing, no changes have been announced.

If you are thinking of buying a property or are already in the process and have questions about stamp duty and applying for concessions or exemptions, feel free to contact me for a no obligation chat.